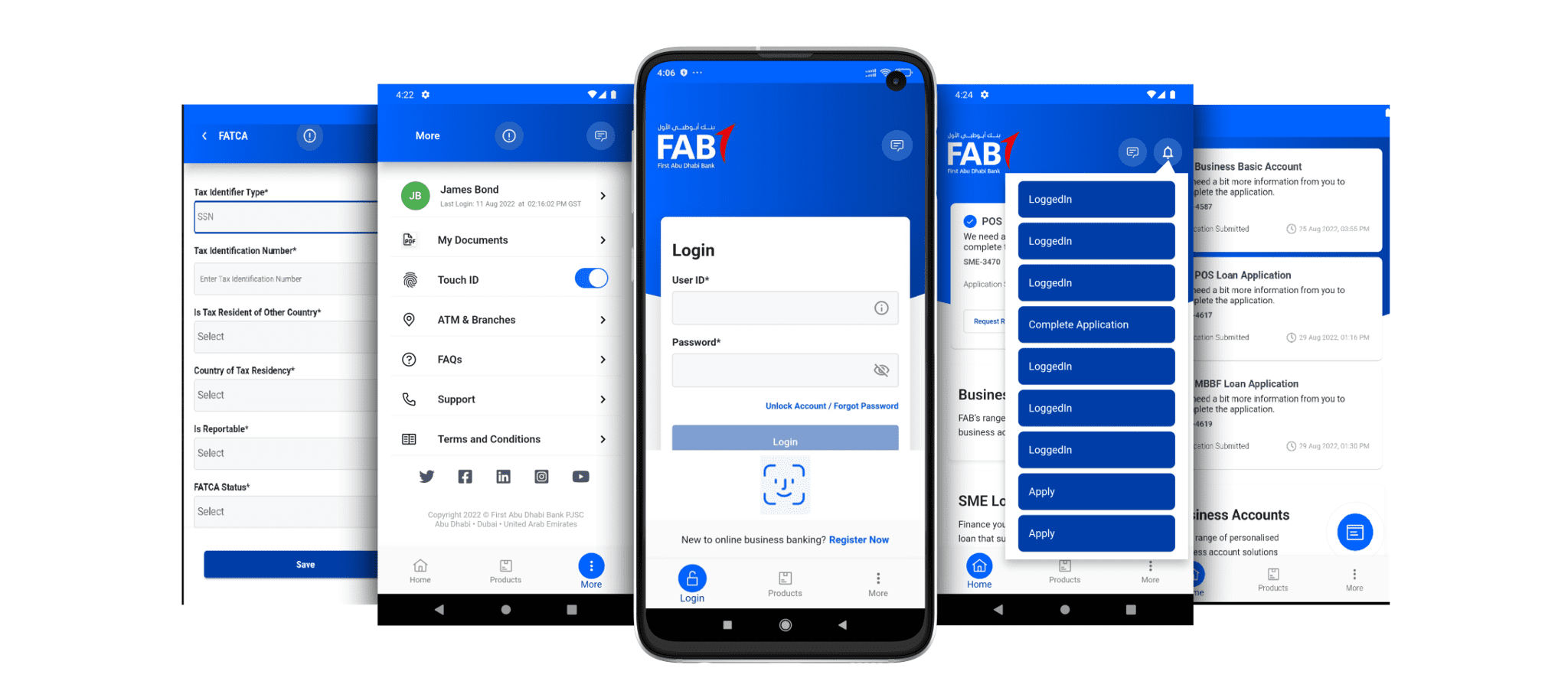

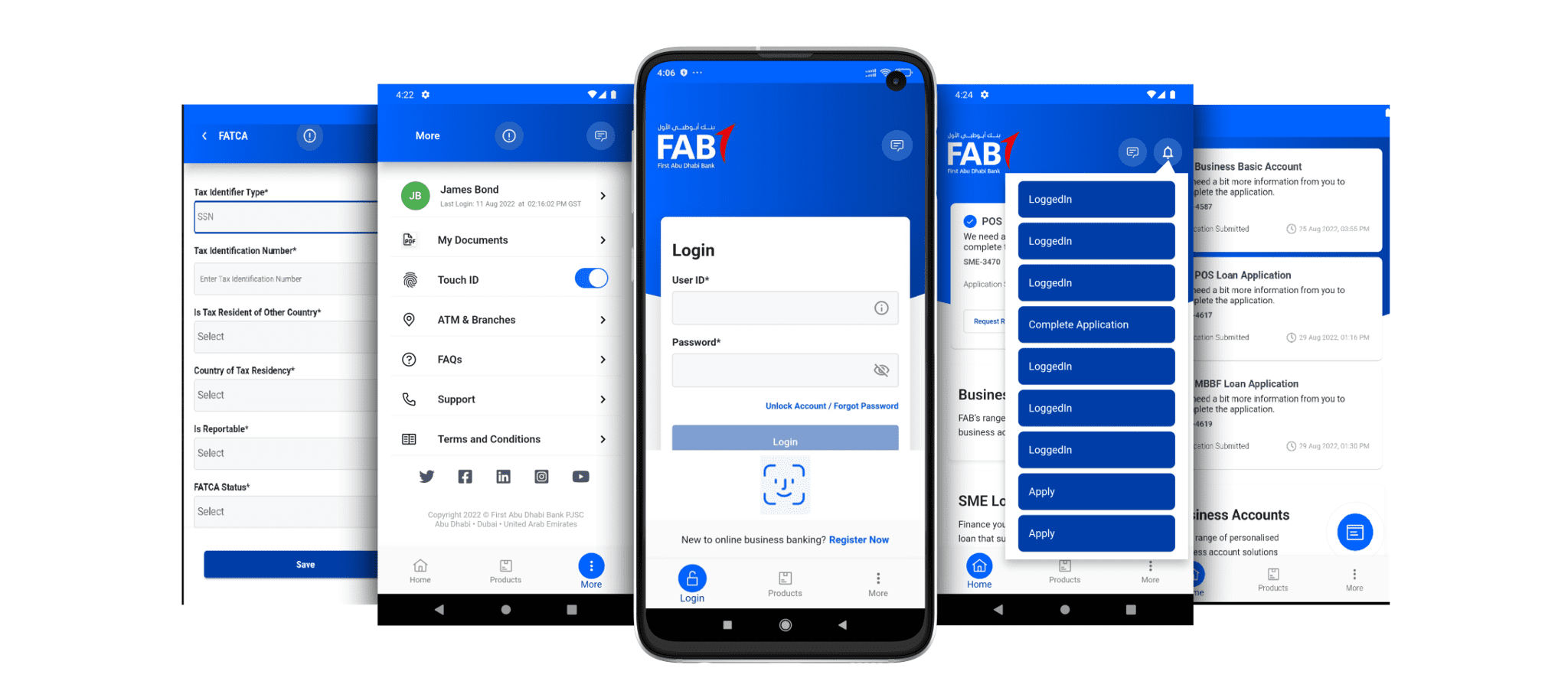

Zelite Solutions Partners with First Abu Dhabi Bank (FAB) to Develop a Mobile Application using Flutter

Zelite Solutions collaborated with First Abu Dhabi Bank (FAB) to create a comprehensive mobile application using Flutter. This initiative aimed to enhance FAB's digital banking services by integrating the app with their core banking system, providing customers with a seamless & efficient banking experience.

Industry

Engagement Model

Current Phase

Time

Solution

Technologies

Introduction

In a strategic collaboration, Zelite Solutions partnered with First Abu Dhabi Bank (FAB) to develop a comprehensive mobile application using Flutter technology. The project aimed to integrate with FAB's core banking system, enhancing the customer experience by providing seamless banking services through a user-friendly mobile interface.

Project Background

First Abu Dhabi Bank (FAB), one of the largest banks in the UAE, sought to innovate its digital banking solutions by developing a mobile application that could streamline various banking processes. The goal was to provide customers with a convenient and efficient way to manage their banking needs, including account opening, loan applications, and other financial services.

Development Process

Zelite Solutions undertook the development of the mobile application, leveraging Flutter technology for its cross-platform capabilities and robust performance. The project was divided into several key phases:

Pre-Approval Solutions:

- POS Pre-Approval: This phase included developing the standard details, process routes, and various screens such as the homepage, login creation, dashboard, product form, applicant details, document upload, and submission screens.

- MBBF Pre-Approval: Similar to the POS pre-approval, this phase focused on capturing the applicant details, performing loan eligibility checks, and facilitating document uploads.

Post-Approval Solutions:

- POS Post-Approval: This phase included capturing customer details, connected parties, key contact information, tax classification, additional KYC, loan application details, document uploads, and post-submission processes.

- MBBF Post-Approval: Focused on the same aspects as the POS post-approval, ensuring a streamlined process for loan applications and document management.

Customer Onboarding:

- Account Opening: This phase involved the development of screens for comparing business accounts, capturing company information, connected parties, key contact details, tax classification, KYC details, account opening details, and post-submission communication via email and SMS.

Features and Integration

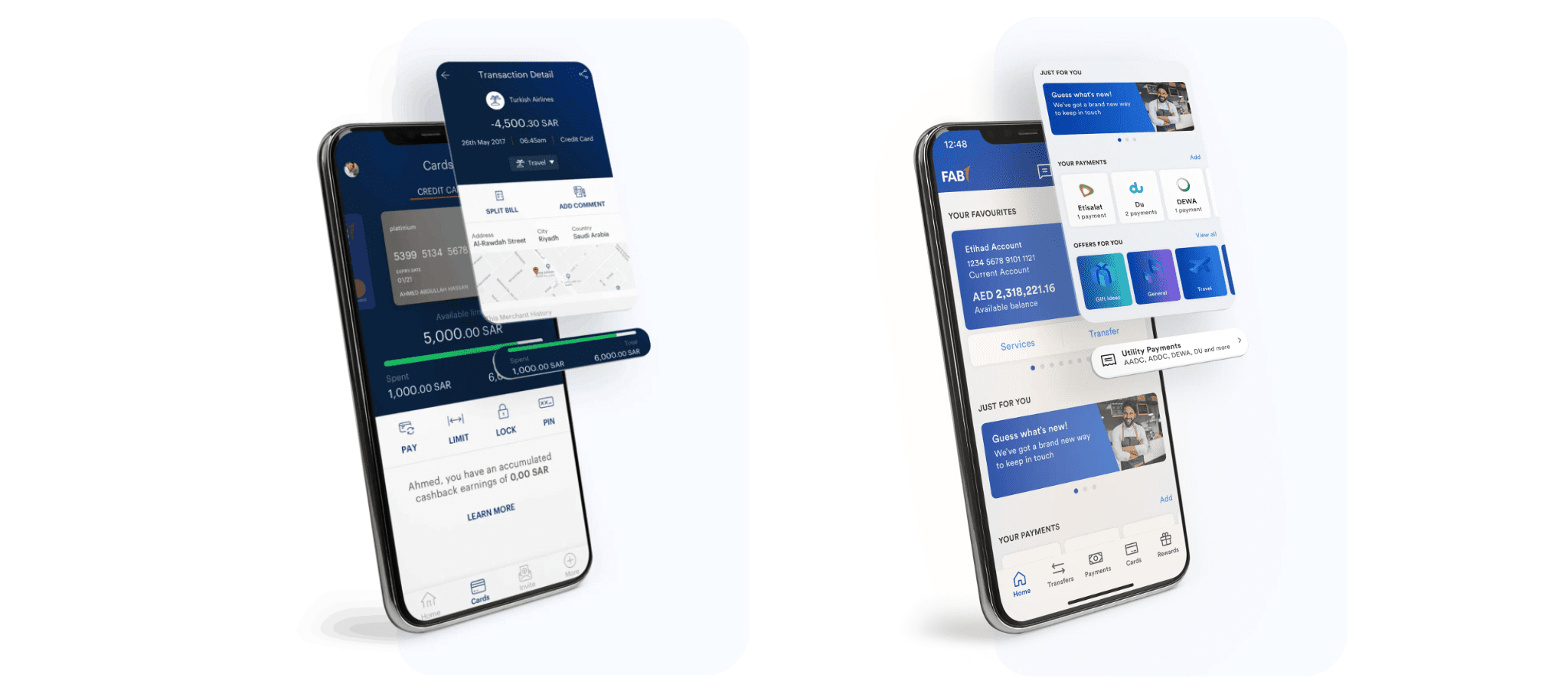

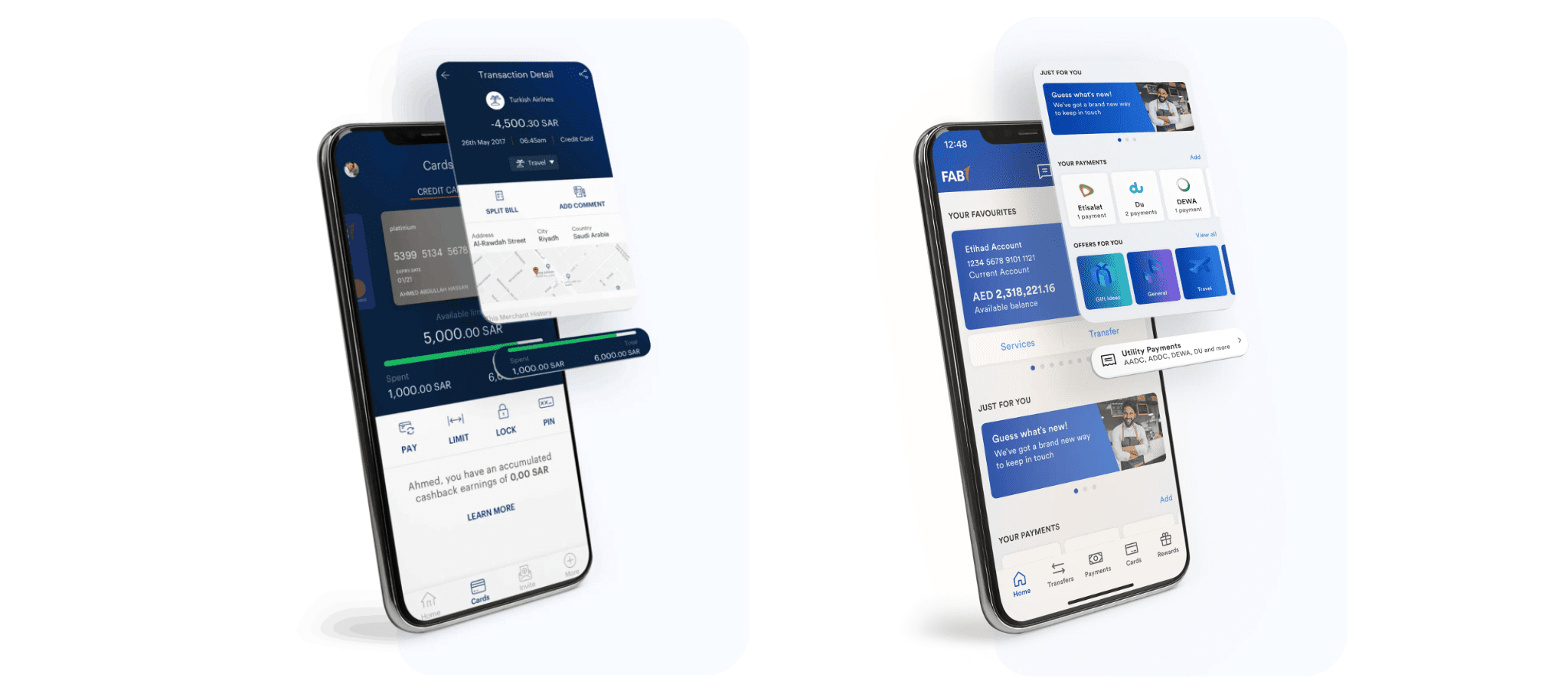

The application featured an intuitive user interface and robust backend integration with FAB’s core banking system. Key features included:

- User Authentication: Secure login and credential creation.

- Dashboard: A comprehensive client dashboard displaying account information and services.

- Loan Applications: Streamlined forms for capturing applicant details, document uploads, and eligibility checks.

- Customer Communication: Automated email and SMS notifications for various stages of the application process.

- Document Management: Efficient document upload and management system.

Challenges and Solutions

During the development process, several challenges were encountered:

- Integration with Core Banking System: Ensuring seamless integration with FAB’s existing systems required meticulous planning and execution.

- Security and Compliance: Adhering to banking regulations and ensuring data security was paramount. The application was designed with robust security measures to protect customer data.

- User Experience: Creating a user-friendly interface that catered to the diverse needs of FAB’s customers was a key focus. Continuous user feedback was incorporated to enhance the application.

Outcomes and Benefits

The successful development and deployment of the mobile application resulted in several benefits:

- Enhanced Customer Experience: Customers could easily access and manage their banking needs through a single mobile application.

- Increased Efficiency: Automated processes reduced the time and effort required for loan applications and account management.

- Improved Communication: Timely notifications and updates kept customers informed at every stage of their banking journey.

- Scalability: The application was designed to accommodate future enhancements and additional features.

Conclusion

The partnership between Zelite Solutions and First Abu Dhabi Bank (FAB) exemplifies the power of collaboration in achieving digital transformation. By leveraging Flutter technology, Zelite Solutions delivered a cutting-edge mobile application that integrated seamlessly with FAB's core banking system, enhancing customer experience and operational efficiency.