Customer Relationship Management (CRM) platforms have become central to how organizations drive revenue, manage customer relationships, and forecast growth. In 2026, CRM is no longer just a sales tracking tool—it is a strategic system that connects sales, marketing, finance, customer service, analytics, and AI-driven insights.

Two platforms continue to dominate CRM discussions globally: Microsoft Dynamics 365 Sales and Salesforce.

Both are mature, enterprise-grade platforms with large ecosystems, strong innovation roadmaps, and global adoption. Yet, choosing between them is not a matter of which product is “better” in absolute terms. The right choice depends on how your organization operates, how it uses data, how it plans to scale, and how deeply CRM needs to integrate with the rest of your enterprise systems.

This blog provides a practical, 2026-focused comparison of Dynamics 365 Sales and Salesforce to help business and IT leaders make an informed decision.

CRM in 2026: What Has Changed?

Before comparing platforms, it is important to understand how CRM expectations have evolved.

In 2026, organizations expect CRM to:- Deliver predictive insights, not just historical reports.

- Integrate seamlessly with finance, ERP, and collaboration tools.

- Support AI-driven decision-making.

- Adapt to complex sales models and long deal cycles.

- Provide leadership-level visibility without manual reporting.

CRM is no longer evaluated only by sales teams. CFOs, CIOs, and CEOs increasingly influence CRM decisions because of its impact on forecasting accuracy, revenue predictability, and enterprise data strategy.

With this context, let us examine how Dynamics 365 Sales and Salesforce compare.

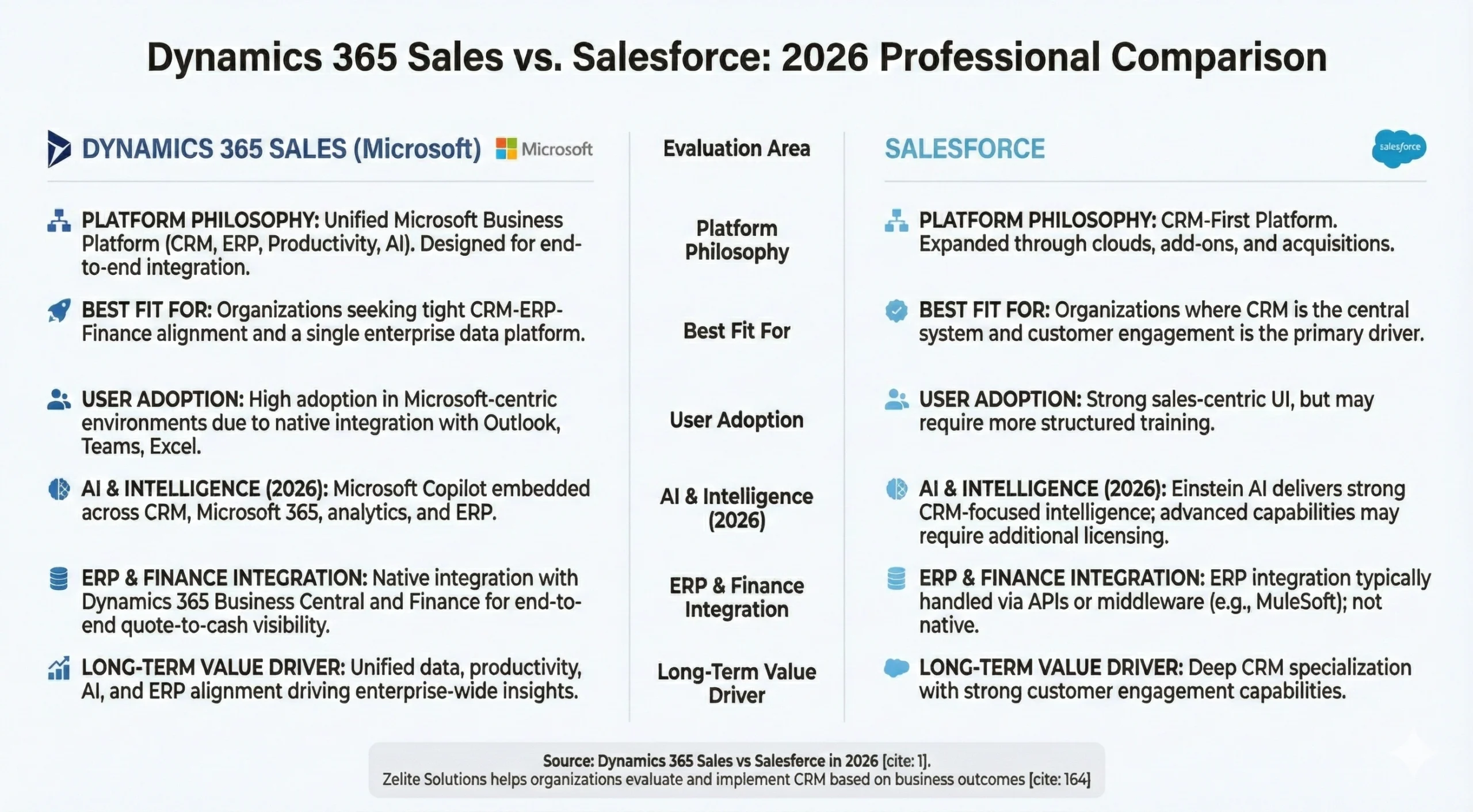

Platform Philosophy and Ecosystem

Dynamics 365 Sales

Dynamics 365 Sales is part of Microsoft’s broader business applications ecosystem. It is designed to work natively with:

- Microsoft 365 (Outlook, Teams, Excel)

- Dynamics 365 Business Central / Finance

- Power Platform

- Azure and Microsoft Fabric

- Microsoft Copilot

The platform follows a unified data and process philosophy, where CRM is not isolated from finance, operations, and collaboration.

Salesforce

Salesforce is a CRM-first platform that has expanded aggressively through acquisitions and add-ons. Its ecosystem includes:

- Sales Cloud

- Service Cloud

- Marketing Cloud

- Data Cloud

- MuleSoft, Tableau, Slack

Salesforce’s strength lies in its CRM specialization and extensibility, especially for customer engagement-heavy organizations.

User Experience and Adoption

Dynamics 365 Sales

Dynamics 365 Sales offers a familiar experience for organizations already using Microsoft tools. Integration with Outlook, Teams, and Excel significantly lowers the learning curve for sales users.

Sales teams can:Dynamics 365 Sales offers a familiar experience for organizations already using Microsoft tools. Integration with Outlook, Teams, and Excel significantly lowers the learning curve for sales users.

Sales teams can:- Track emails and meetings directly from Outlook.

- Collaborate through Teams without leaving CRM.

- Analyze data using Excel with live connections.

This familiarity often leads to higher adoption in Microsoft-centric organizations.

Salesforce

Salesforce provides a polished and intuitive CRM interface, especially for sales-centric workflows. It is widely regarded for its strong UI consistency across sales processes.

However, organizations that are not already aligned with Salesforce’s ecosystem may require additional training and change management to drive adoption.

Sales Process Management and Customization

Dynamics 365 Sales

Dynamics 365 Sales is well-suited for complex, structured sales processes, particularly in B2B environments with long sales cycles.

Strengths include:- Flexible business process flows

- Strong role-based security

- Native extensibility using Power Platform

- Deep integration with ERP for quote-to-cash alignment

Customization is typically handled through configuration and low-code extensions, reducing dependency on heavy custom development.

Salesforce

Salesforce is highly customizable and supports a wide range of sales models, from transactional to enterprise selling.

However, advanced customization often relies on:

- Apex code

- Salesforce-specific development skills

- Additional platform components

This can increase long-term complexity if governance is not well managed.

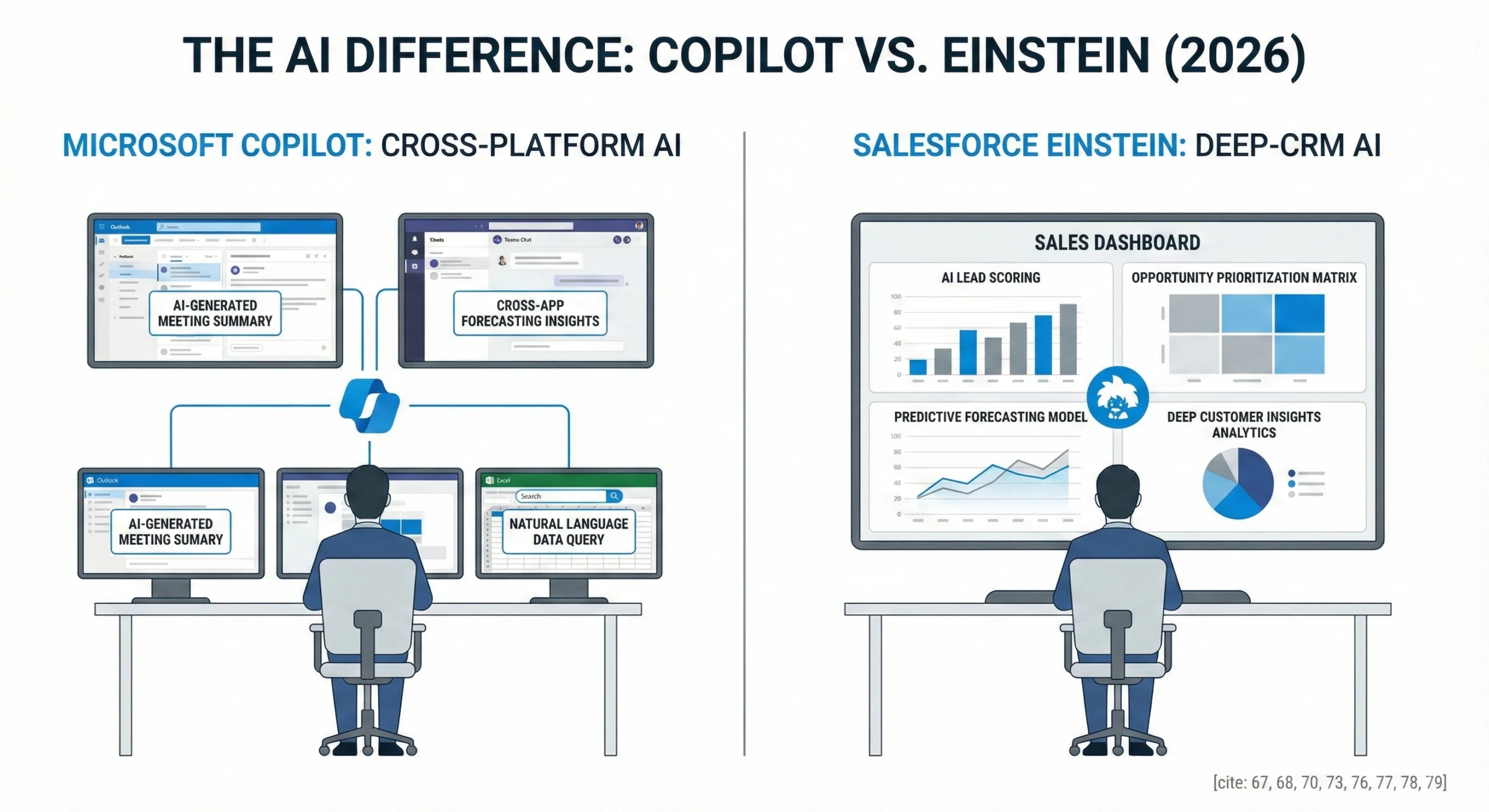

AI and Intelligence Capabilities

Dynamics 365 Sales and Copilot

In 2026, AI has become a differentiator. Dynamics 365 Sales leverages Microsoft Copilot, embedded across CRM, Microsoft 365, and analytics.

Capabilities include:- AI-generated opportunity summaries

- Sales forecasting insights

- Next-best action recommendations

- Natural language queries over CRM data

- Meeting and email summarization

Salesforce Einstein

Salesforce Einstein

Salesforce Einstein provides AI-driven insights for:

- Lead scoring

- Opportunity prioritization

- Forecasting

- Customer insights

Einstein is a strong AI engine, particularly for sales-centric use cases. However, many advanced capabilities require additional licensing and configuration.

Reporting, Analytics, and Forecasting

Dynamics 365 Sales

Dynamics 365 Sales integrates natively with:- Power BI

- Microsoft Fabric

- Excel

- Build enterprise-wide dashboards

- Combine CRM data with ERP and financial data

- Provide leadership-level insights without manual consolidation

Forecasting models benefit from shared data across systems, improving accuracy and trust.

Salesforce

Salesforce offers strong native reporting and advanced analytics through Tableau and Data Cloud.

While powerful, analytics often remain CRM-centric unless additional integration work is done to unify enterprise data.

Integration with ERP and Finance Systems

Dynamics 365 Sales

One of the strongest differentiators for Dynamics 365 Sales is its native alignment with ERP systems, particularly:

- Dynamics 365 Business Central

- Dynamics 365 Finance

- End-to-end quote-to-cash visibility

- Unified customer and revenue data

- Better forecasting and financial planning

For organizations where CRM and ERP alignment is critical, this is a significant advantage.

Salesforce

Salesforce

Salesforce integrates well with ERP systems through APIs and middleware such as MuleSoft.

However, ERP integration is typically additive, not native. This can increase implementation effort and long-term maintenance, especially in complex environments.

Cost Structure and Total Cost of Ownership

Dynamics 365 Sales

Dynamics 365 Sales licensing is generally perceived as more predictable, especially for organizations already using Microsoft products.

Benefits include:

- Bundled ecosystem value.

- Lower integration costs

- Reduced dependency on third-party tools

Total cost of ownership often benefits from ecosystem alignment rather than standalone CRM costs.

Salesforce

Salesforce licensing can scale quickly as:

- Additional clouds are added

- AI and analytics features are enabled

- Integration tools are required

While Salesforce is highly capable, organizations must carefully model long-term costs beyond initial licensing.

Scalability and Long-Term Flexibility

Dynamics 365 Sales

Dynamics 365 Sales scales well for organizations that plan to:

- Expand ERP usage

- Adopt Power Platform

- Leverage AI and analytics

- Standardize on Microsoft infrastructure.

It supports a unified digital platform strategy, which reduces fragmentation over time.

Salesforce

Salesforce scales extremely well for:- Customer engagement-heavy organizations

- Marketing-led growth strategies

- Industries with complex customer journeys

However, scalability often comes with increased platform complexity if governance is not enforced.

Which CRM Is Right for Your Business?

There is no universal answer, but clear patterns emerge.

Dynamics 365 Sales is typically the better fit if:

- Your organization is already invested in Microsoft 365 and Azure

- CRM must integrate tightly with ERP and finance

- You want a unified data and analytics strategy

- AI and productivity tools need to work across the enterprise

Salesforce is typically the better fit if:

- CRM is the central system, independent of ERP

- Customer engagement and marketing automation are primary drivers

- You have strong Salesforce expertise in-house

- You prefer a CRM-first ecosystem

Final Thoughts

In 2026, the CRM decision is less about features and more about platform alignment.

Both Dynamics 365 Sales and Salesforce are capable platforms. The real question is how well the CRM aligns with your broader business architecture, data strategy, and growth plans.

Organizations that choose wisely focus on:

- Long-term scalability

- Data consistency

- User adoption

- Integration depth

- AI readiness

CRM success is determined not by the tool alone, but by how effectively it is implemented and adopted.

Executive Comparison: Dynamics 365 Sales vs Salesforce (2026

| Evaluation Area | Dynamics 365 Sales | Salesforce |

|---|---|---|

| Platform Philosophy | Part of a unified Microsoft business platform (CRM, ERP, productivity, analytics, AI). Designed for end-to-end business integration. | CRM-first platform expanded through clouds, add-ons, and acquisitions. Strong focus on customer engagement. |

| Best Fit For | Organizations seeking tight CRM-ERP-Finance alignment and a single enterprise data platform. | Organizations where CRM is the central system and customer engagement is the primary driver. |

| User Adoption | High adoption in Microsoft-centric environments due to native integration with Outlook, Teams, and Excel. | Strong sales-centric UI, but may require more structured training outside Salesforce-centric teams. |

| Sales Process Complexity | Well-suited for complex B2B sales cycles with structured processes and governance. | Highly flexible for a wide range of sales models, including transactional and enterprise selling. |

| Customization Approach | Configuration-first with low-code extensibility via Power Platform; reduced dependency on custom code. | Powerful customization, often requiring Apex development and Salesforce-specific skills. |

| AI & Intelligence (2026) | Microsoft Copilot embedded across CRM, Microsoft 365, analytics, and ERP for enterprise-wide AI assistance. | Einstein AI delivers strong CRM-focused intelligence; advanced capabilities may require additional licensing. |

| Forecasting & Analytics | Native integration with Power BI and Microsoft Fabric enables enterprise-wide forecasting and reporting. | Strong CRM analytics with Tableau and Data Cloud; broader enterprise analytics require integration effort. |

| ERP & Finance Integration | Native integration with Dynamics 365 Business Central and Finance for end-to-end quote-to-cash visibility. | ERP integration typically handled via APIs or middleware such as MuleSoft; not native by default. |

| Ecosystem Alignment | Best for organizations standardizing on Microsoft 365, Azure, Power Platform, and Fabric. | Best for organizations committed to Salesforce’s CRM-centric ecosystem and cloud stack. |

| Total Cost of Ownership | Generally more predictable, especially for Microsoft-aligned organizations; lower integration overhead. | Can scale significantly as additional clouds, AI, and integration tools are added. |

| Scalability Strategy | Scales as part of a broader enterprise digital platform with shared data and governance. | Scales extremely well for CRM and customer engagement, but governance is critical to manage complexity. |

| Long-Term Value Driver | Unified data, productivity, AI, and ERP alignment driving enterprise-wide insights. | Deep CRM specialization with strong customer engagement capabilities. |

How Zelite Solutions Can Help

Zelite Solutions helps organizations evaluate, implement, and optimize CRM platforms based on business outcomes, not product bias.

We work with clients to:- Assess CRM readiness

- Compare Dynamics 365 and Salesforce objectively

- Design scalable architectures

- Implement CRM with strong governance and adoption focus

Our goal is to help organizations choose and implement the CRM platform that delivers measurable, long-term value.